TradFi's Race to the Bottom.

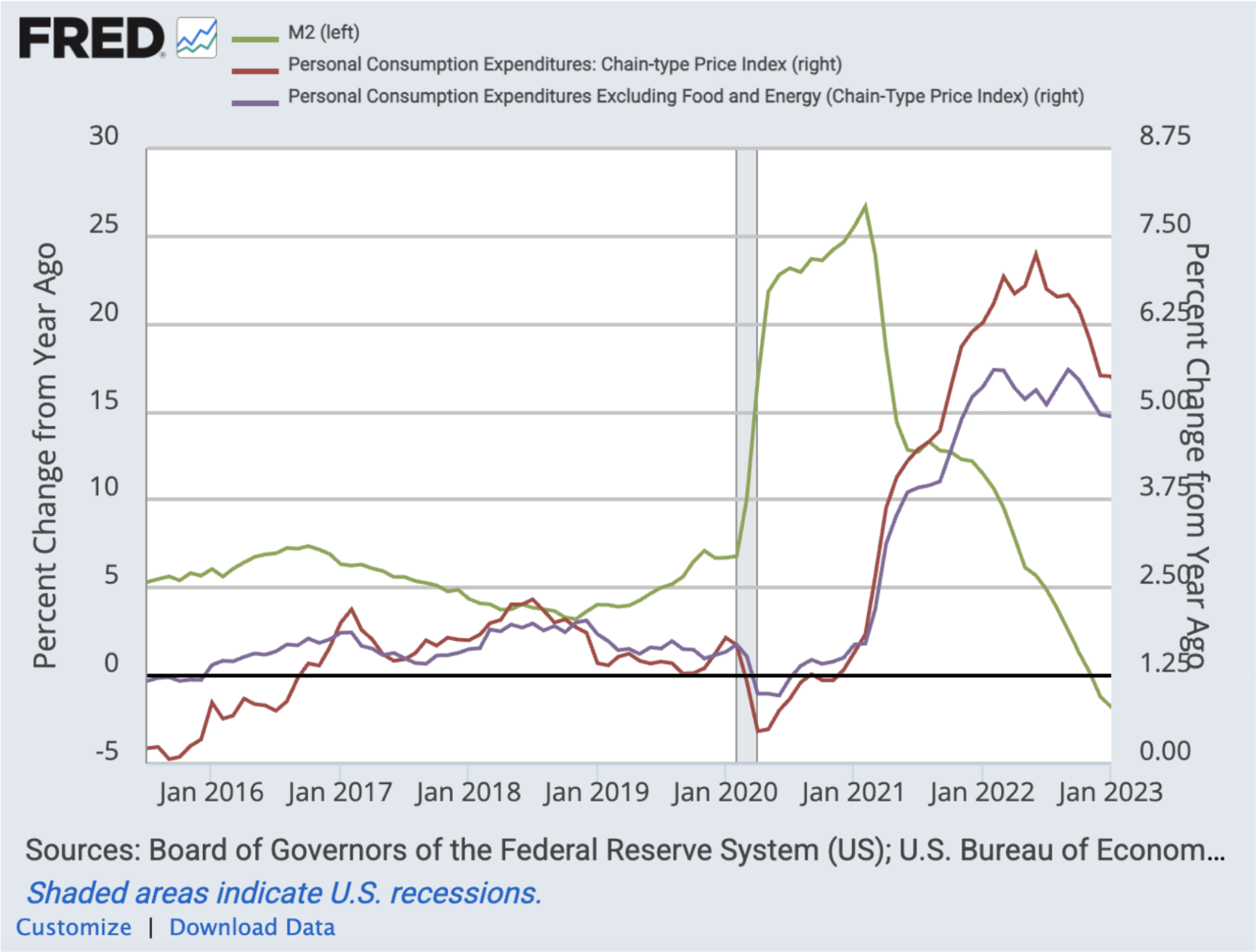

The world we live in today operates much like a candy machine. Governments sustain the economy by relying on debt. Money is printed without backing so the only way to repay existing debt is to issue new debt and roll it forward. This cycle has been compounding for decades, but during COVID outbreak the candy machine went into sugar rush mode. U.S. broad money supply (M2) expanded at record levels issuing nearly half (≈ 47 %) of all of the U.S. dollar “stock” since 2020. In other words every second US Dollar that has ever existed was printed in the last 5 years alone.

This last credit cycle created an astronomical amount of debt, around $12 trillion from the US government alone, that will need to be paid with new loans in the future. This increases the risk, because those large debt obligations will have to be extended at whatever interest rates are available at that time regardless of whether they’re low or not.

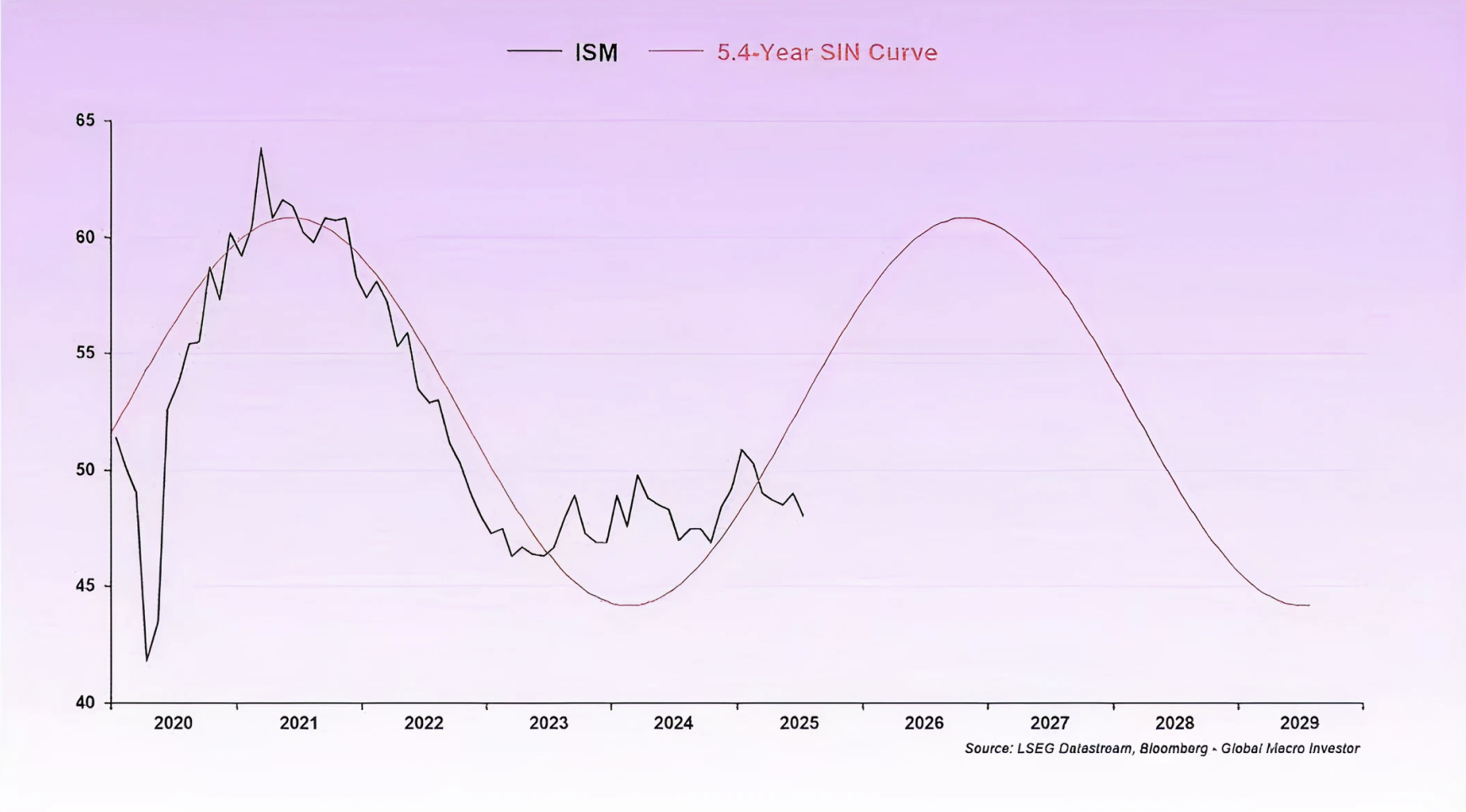

Currently, the average time to maturity for marketable debt is 5.4 years, meaning refinancing pressure is imminent and intense.

So welcome to 2025.

If this bull market feels different it's because it doesn't stem from strength. No war has been won, no global trade agreement has been signed, no pandemic has ended.

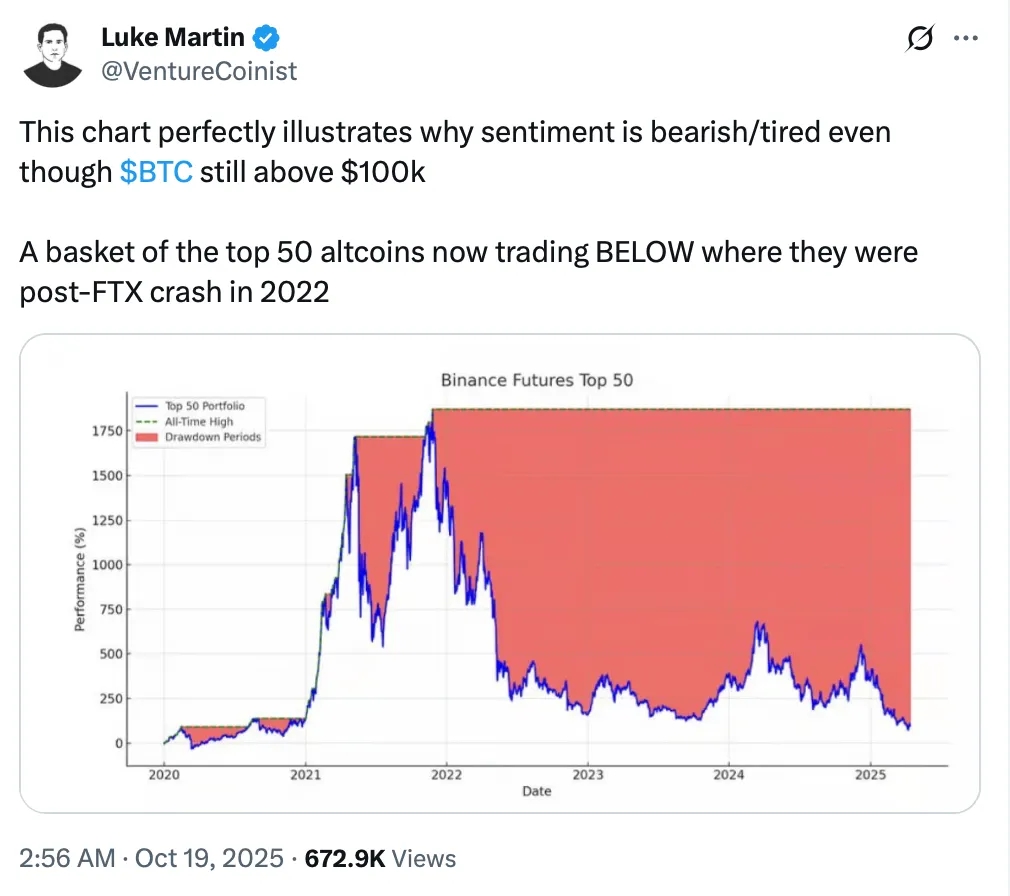

The altcoin market is still nursing wounds from the last cycle’s low-float, high-FDV, insider extraction.

Instead, what we do have, is the insolvent US sovereign that needs to roll over an astronomical amount of debt from the last pandemic whilst keeping demand for the dollar alive.

One way to get there is to accelerate the financialisation of the world & increase demand for US treasuries by denominating it all in USD. This is the macro role of stablecoins and the gov thesis for crypto itself: unlimited assets, universal liquidity, max velocity.

So we now use crypto to make everything liquid and hyper speculative: 24/7 venues, $FARTCOIN perps, instant settlement rails. Attention itself becomes a monetary input. All traded against USD.

But crypto is no exception here and so the asset side economy has been sprinting since 2020, while the everyday economy crawls. Wages and household balance sheets lag asset inflation, so people feel poorer even as indexes print new highs.

Net result: a world optimized for turnover, not well-being.

Fuel for extractive commerce

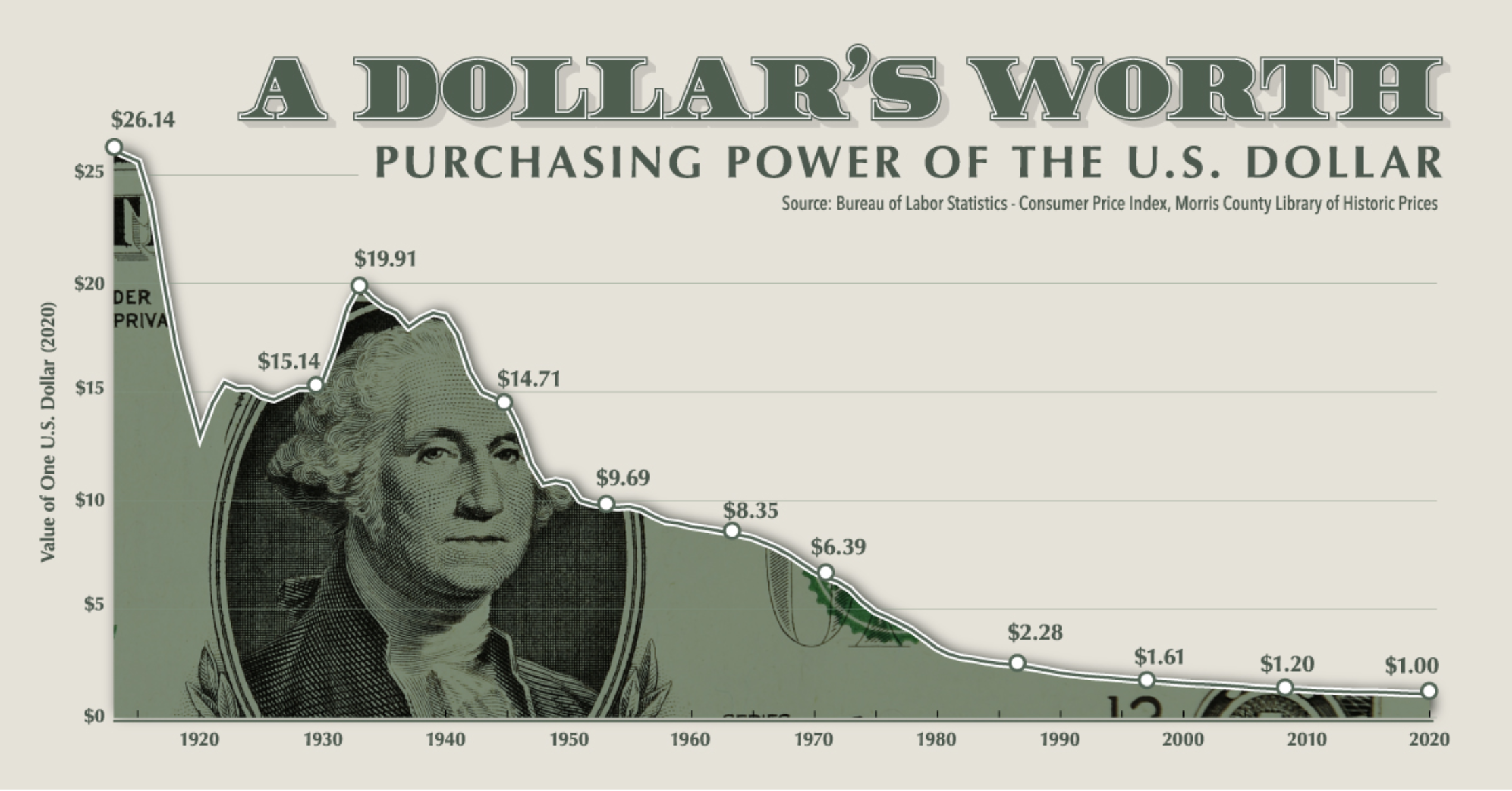

Fiat’s constant dilution rewards high velocity of money. And that incentive lands directly into retail commerce too.

Global e-commerce hit $26.7T in GMV last year (B2B + B2C) because it perfectly exploits these incentives. Weak money lifts time preference. Boards, CFOs, and operators are pushed to pull cash forward: shorten the cash-conversion cycle, move units, turn inventory, recycle cash faster. When your currency melts, you optimize for speed. Planned obsolescence, cheap polluting materials, inhumane sweatshops, are all consequences of it. Why build something good and lasting when your P&L prefers the customer to rebuy quickly? Just like the financial system, the consumption cycle is also running a race to the bottom.

Consumers flip the bill.

50 years of fiat money and inflation have simply meant a relentless erosion of the average household’s purchasing power. Nonstop monetary expansion and asset inflation have outpaced wages; “doing fine” often just means “not falling further behind.

Consumers truly are the abandoned children of capitalism.

You build no equity in what you buy. Your loyalty doesn't compound. Your data is used against you. And you end up with worse products.

That’s how you get the TikTok → Temu → Trash world we live in.

Stop being the product.

The world clearly doesn’t need another shopping app. But it does need a new consumer story, one where consumption doesn’t end in waste & regret, but begins with intent & value reciprocity.

Nomu exists to flip the early-user paradox & Web 2’s race to the bottom; replacing one-way checkouts with reflexive highways where the value you help create flows back to you.

Reflexive commerce is a new market primitive that prices merit: those who drive a product’s success participate in the value they helped create.

Instead of T

TikTok → Temu → Trash

We're building X → Nomu → Earn

Discover a product. → Preorder it. → Get rewarded when it sells.

You’re not just the launch fuel anymore. You help something take off, and you keep a piece of the flight.

But the vision goes further.

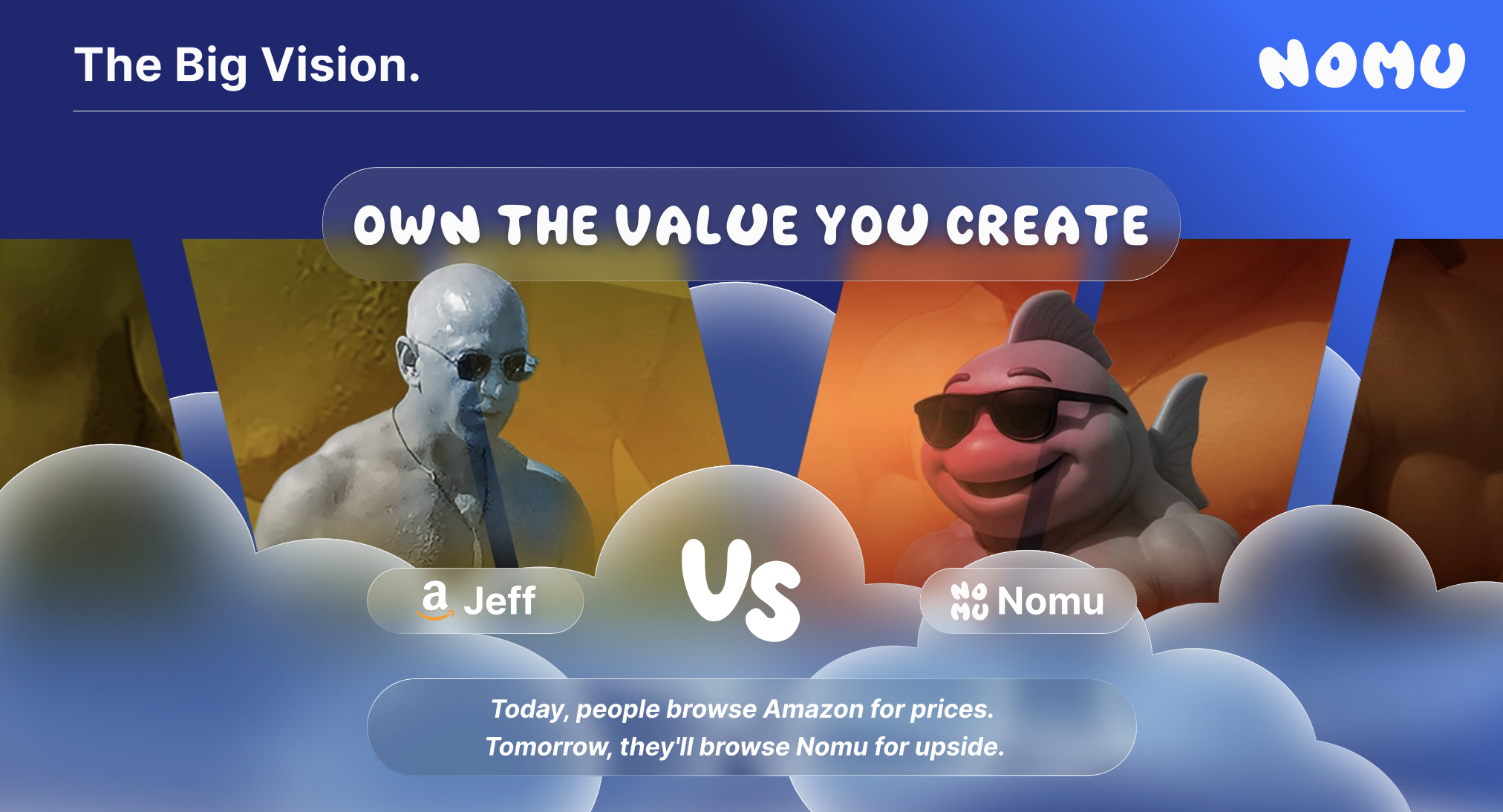

Today, people browse Amazon & Temu for cheaper prices. Tomorrow, they’ll browse Nomu for greater upsides; a universal storefront where consumers become partners, and every sale rewards the community that made it happen.

We replace wasteful overconsumption and instant gratification with conscious consumption and compounding value.

And maybe, just maybe, buying things will feel good again.